Feature: Evolutions in leasing

The ability to keep staff moving on a local, regional or national level can be a challenge. Dave Moss looks at how more flexible vehicle procurement options are helping to ease the pain.

LeasePlan’s Berno Kleinherenbrink says there’s a new trend that’s seeing fleets move from paying for availability to paying for use

“If you can’t beat ‘em, join ‘em – or buy ‘em’”. That appears to be the approach taken by the major daily rental operators when faced with the potential threat posed by the leading car-sharing companies.

According to recent data from Frost and Sullivan’s global Automotive and Transportation practice, leasing is currently the most popular way of financing company cars in 26 European markets, with an estimated 13.3 million units on lease in 2017. Operational or full-service leasing accounts for 18.5% of fleet vehicles in use, and finance leasing another 9.9% – with the EU ‘big five’ countries alone accounting for two-thirds of the European (EU26) leasing market.

Full service leasing is still growing fast in several emerging markets, particularly Eastern Europe and Asia, but the products and services offered are increasingly flexible, and widening far beyond vehicle sourcing, financing, management and control.

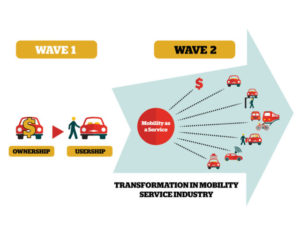

Shwetha Surender, Frost and Sullivan’s industry principal for mobility, sees public attitudes shifting from viewing cars as products towards cars as a service, and evolving towards a broader view of Mobility as a Service. (MaaS) “This trend is filtering through to the corporate sector,” she says. “Increasingly, corporates are re-evaluating the way they budget transport, shifting from a total cost of ownership approach to total cost of mobility, including expenditure on all modes of transport – such as car rentals and taxis.”

It’s a change noted by Berno Kleinherenbrink, senior corporate VP commercial at LeasePlan. “The vast majority of our customers are still focused on total cost of ownership,” he says. “The cost of finance and operating a vehicle is not increasing, as we, and our competitors, are willing to share savings with customers. But companies are revisiting mobility solutions – there’s a new trend – moving from pay for availability to pay for use.”

The green factor

Free2Move Lease is part of the French PSA group’s fleet mobility solutions enterprise, currently being rolled out in Europe, beginning with the UK. Managing director Duncan Chumley agrees big changes are underway: “Large fleets are looking at how they can reduce their environmental impact, asking if they can reduce or share the way people travel on company business to deliver a positive effect. And technology is improving as more vehicles become connected, allowing more analysis than has ever been possible before.”

Technology has already brought 24/7 mobility to the work environment: now its potential to revolutionise staff business travel is increasingly being recognised – and utilised. Providing mobile access across telematics-equipped, connected cars, cloud-based company systems and mobility services from growing numbers of specialist international providers promises more efficient company travel – and improved controls.

Chumley sees an important issue here: “To make corporate mobility solutions work in the future, they must be simple, providing one single tool, most likely a smartphone, for users to look at all the options,” he says. “The key is how to successfully link internal and external platforms in one place, connecting to telematics in the car and mobility solutions outside, to decide on the best way to complete a journey – by car, train, or other means such as bikes.”

Such ‘always-on’ mobile systems, allowing secure, controlled contact between a company, its vehicles, staff and chosen external mobility services, open up a new world of big data, capable of providing fleet, travel and financial managers with a continuous company-wide view of staff travel – and its costs.

“Today managers are focused on owned assets, but by using big data they could look at introducing alternative modes of transport, and analyse employee movements,” states Justin Whitston, chief executive of Fleetondemand, a business MaaS provider. “Benefits include increased engagement, smart decision-making, cost and time reductions, introduction of new mobility services – and greater corporate social responsibility,” he adds.

A problem shared…

Technology is a big driver for adoption of shared fleets and enabling MaaS, according to Surender – though some disadvantages will have to be overcome. “There are concerns around system interfaces, and integrated mobility would need interactions with customer systems,” she says. “Those requiring deep connections will likely put opportunity into the ‘too hard to deliver’ box.”

That the fleet management role must change as mobility technology advances seems certain. Could a merging of company services and systems eventually turn fleet managers into travel managers, or the reverse? “We’re seeing a trend in which companies – especially in urban areas – are defining mobility in broader terms,” believes David Voggeser, manager of HKP group, a Frankfurt-based international compensation consultancy. “Instead of only describing how and which company car an employee may receive, more often now its about detailing which mobility solutions a company offers. Changes in peoples’ mobility behaviour are driving companies to rethink their corporate vehicle fleet; sometimes making cars less desirable.”

Voggeser makes the point that in urban areas, cars can have downsides and that there are plenty of other mobility solutions which can be utilised. “It therefore makes good sense for companies to include available mobility solutions as part of their policies,” he reasons.

Look who’s driving

A move towards mobility rather than fleet management brings questions about who might need company cars in future – and their use.

“Among the forces of change, some will affect attitudes to mobility,” says Tom De Vleesschauwer, transport and mobility practice leader at IHS Markit – and one of the authors of a study looking at future trends to 2040. “The younger generation don’t necessarily equate car ownership with mobility and its also likely that corporate social responsibility and ‘green issues’ will start affecting approaches, with larger public companies wanting to show their caring attitude and environmental responsibility – by relying less on cars, and encouraging car-pooling and other initiatives.”

Chumley believes the days of company cars as status symbols may be passing: “Today, fewer people, especially those working in cities, see a company car as a status symbol – and in some instances they may not even drive, so it’s not as relevant as it was for the younger generation moving into more senior positions,” he says. “One of the keys for company car drivers will be the benefit available if your car could be used differently, and by other people. Maybe renting your car out could bring tax concessions, or allow a better car. From a company asset perspective, most cars represent a daily cost. If costs can be reduced by using the asset more efficiently, that has to be beneficial.”

Also looking forward, Surender thinks corporate mobility will eventually centre on comprehensive Mobility as a Service offerings, accessing multiple modes of transport. “The first step is uptake of corporate carsharing, where in the last three years Europe has seen compound annual growth around 34%,” she says. “There are over 15 corporate carsharing providers across Europe, ranging from fleet and leasing companies to OEMs, as well as emerging third party telematics providers such as Vulog and Inverse.”

Corporate urban mobility is undergoing a hidden revolution…

Over 60% of EU citizens live in urban areas with populations over 10,000 people, and for many years the European Commission (EC) has worked towards providing cleaner and better urban transport – through targeted policies, and by financing specific projects.

The EC’s Directorate-General for Mobility and Transport has funded the CIVITAS initiative since 2002, and its work is central to the Commission’s urban mobility agenda. It is currently supporting three “living labs” projects, involving sustainable mobility solutions, and 14 EC-funded research projects.

The CIVITAS 2009 Urban Mobility Action Plan is now delivering many new, efficient, and sustainable urban transport systems and approaches in Europe – though the most high profile target so far announced is to phase conventionally-fuelled vehicles out of European cities by 2050.

Currently over 250 European cities are either part of the organisation’s co-funded urban mobility programmes, or are independently financing similar high-level commitments to introduce ambitious, sustainable, urban transport strategies.

Meanwhile “Cities for Mobility” promotes similar aims globally, encouraging cooperation between business, city administrations, transport companies and science. It seeks to safeguard smoothly functioning cities as attractive locations for the local economy, with members in over 50 countries in Latin and North America, Europe, Africa, and Asia.

Future urban area travel – could mobility budgets be the answer?

Mobility budgets are gaining acceptance amongst European companies using vehicles in urban areas where regulations limiting vehicle access exist or are planned to reduce congestion or pollution. Brussels has just introduced an environmental zone covering its 19 metropolitan areas, and last year Belgium began a ‘Cash for Car’ plan allowing company car benefits to be exchanged for cash payments at a low tax rate – when used for alternative mobility. France, which recently announced six more ZCA and ZPR environmental zones, requires mobility plans for companies with over 100 employees.

More vehicle usage restrictions are anticipated in major cities, mostly low emission zones or urban area congestion charging. The possibility of a Europe-wide ban on diesel engines by 2040 has also been suggested.

Growing environmental and congestion-based traffic restrictions make careful planning essential to ensure efficient staff mobility in future. While mobility budgets are one possibility, today a wide choice of available solutions allow flexibility and innovation in developing new urban transport policies for business. This might involve modifying existing arrangements – or considering completely new options including public transport, so-called ‘last mile’ shuttles, corporate car sharing, ride hailing, and a growing range of smartphone-accessible, subscription-based mobility services.