Business Mobility: More than a lease car

Kevin Loeffelbein, senior manager future mobility, Capgemini Invent, and Manuel Schneider, business strategy manager, Alphabet International, on the changing face of fleet management.

Fleet management is fast evolving into mobility management

Due to digitalisation, urbanisation and new ways of working, business mobility is on a path of disruptive change. From established OEMs to innovative start-ups, the business mobility landscape is becoming more diverse, competitive and interconnected.

Elaborating these trends, Alphabet International and Capgemini Invent (formerly Capgemini Consulting) have conducted a joint innovation study, which was conducted mainly in Germany and the Netherlands, providing insights of a sample of more than 800 drivers of corporate or private lease cars and thus the end customers of business mobility. The sample can be classified as ‘user-choosers’, which are described as digital-savvy, flexibility-oriented and brand-loyal to mirror their social position.

The survey summarises trends in three business mobility areas: digital/connected services within corporate vehicles, flexible mobility solutions and (fleet) data security. In the following both mobility providers and fleet managers received a profound overview of these findings.

Company car digital basics

Fleets are interested in connected car services but generally unwilling to pay extra

The results highlight a discrepancy between the interest in digital and connected services and the willingness to pay for them. As an example, on average 79% of user-choosers are interested in additional in-car services (94% in navigation services, 63% in information services like weather or news, 79% in repair services) as part of their company vehicle package. Nevertheless, only an average of 14% is willing to spend extra personal budget on these services. On the other side, there is a higher willingness to pay (20%) for connected communication and entertainment services like smartphone/music integration, while readiness to spend extra money on office or smart home applications within the mobility service still lingers at around 10%.

Although there is a tendency of younger user-choosers from 20-40 years having a higher willingness to pay extra for connected services, this target group states that they are expecting these features as a commodity offer from their mobility providers. As a further challenge, corporate user-choosers note that their company policies often restrict the use of modern digital services within the company car.

To pay for these services, user-choosers prefer pay-per-use (40%) or subscriptions added to their monthly leasing rate (38%) instead of single payments or integration into their existing leasing contract (25%). This represents the mentioned attitude of user-choosers towards flexible solutions.

Flexibility is key

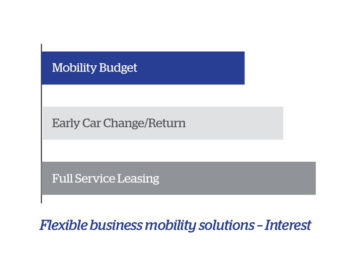

Besides payment, the survey shows that the demand for flexibility is a major driver even with regards to new business models. Monthly mobility budgets for instance, which can be used for intermodal transportation, are becoming increasingly more relevant for mobility providers, as they support an independent lifestyle. While in Germany 47% of user-choosers are interested in a mobility budget (depending on location), 73% of their Dutch counterparts are wanting to create their own mobility composition by a given monthly budget, partly due to the decentralised structure and commuting behaviour in the Netherlands. At the same time and across all surveyed countries, only one out of 10 respondents was willing to completely give up their private car use, showing that mobility budgets seem to be at least a complementary product alongside car-based solutions. Herewith, there is also a high demand for flexible vehicle solutions like early car change/ return (71%) or full-service leasing contracts including fuel, maintenance or other add-ons (81%).

Despite the fact that ownership of cars will still matter, further outcomes of the survey demonstrate a shifting composition of mobility usage in the future. Particularly in urban areas, user-choosers expect a more integrated, seamless and hassle-free journey from A to B.

With a share of 6% today, respondents state that their car sharing usage is expected to increase up to 11% until 2023 with a continuous upward trend. Mobility providers are anticipating this trend both in the B2B and the B2C sector, leveraging their car sharing and fleet management capabilities more and more.

This could also be a channel to push electric vehicles (EVs), which are still far below expectations regarding their share within corporate fleets of about 2% at the end of 2017. Although user-choosers generally show a high interest in leasing electric vehicles (63%), they express the well-known barriers of lacking charging infrastructure, range and low subsidies. Shared corporate EVs on the other hand could face these challenges with companies taking the risk and providing incentives to their employees.

Shared data only with incentives

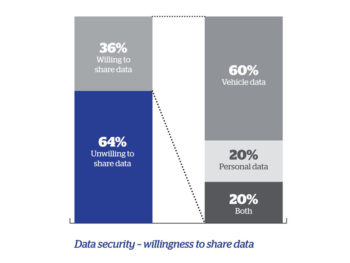

The majority of the survey’s respondents are not willing or undecided to share personal or vehicle data

With regard to the mentioned services, data privacy is a controversial topic. With 64%, the majority of the survey’s respondents are not willing or undecided to share personal or vehicle data, mostly because of security or transparency issues towards providers or their own fleet managers. However, around 40% would share these data when “the right” incentives like reduced leasing rates or active contribution to improvement programmes are given.

Of those that are willing to share their data, 60% would share vehicle-related data, while only one out of five drivers would share personal data like driving behaviour. To increase the latter, fleet managers are already introducing incentive programmes to reward their employees for exemplary driving and at the same time to contribute to sustainable solutions.

Be it digital or connected services, new on-demand vehicle business models or data analytics and smart leasing contracts: the market of business mobility is evolving, together with infrastructure developments in a broader sense. It will be important for mobility providers and fleet managers to actually listen to their end customers, the user-choosers, as they will shape both future demand and corresponding services.