Free data source to help firms manage Covid-19 impact on used cars

Indicata is providing a free information source to help remarketing professionals with used vehicle decisions during the Covid-19 pandemic.

The firm says its Market Watch analysis already shows the impact of the outbreak on used car sales across 13 European markets, including the UK, during March and the impact on used prices during March and April. Although initial analysis had shown that only Italy, which was fully in the grip of the pandemic, had seen a significant market shift, latest data – two weeks on – shows the impact across many European countries has now been abrupt.

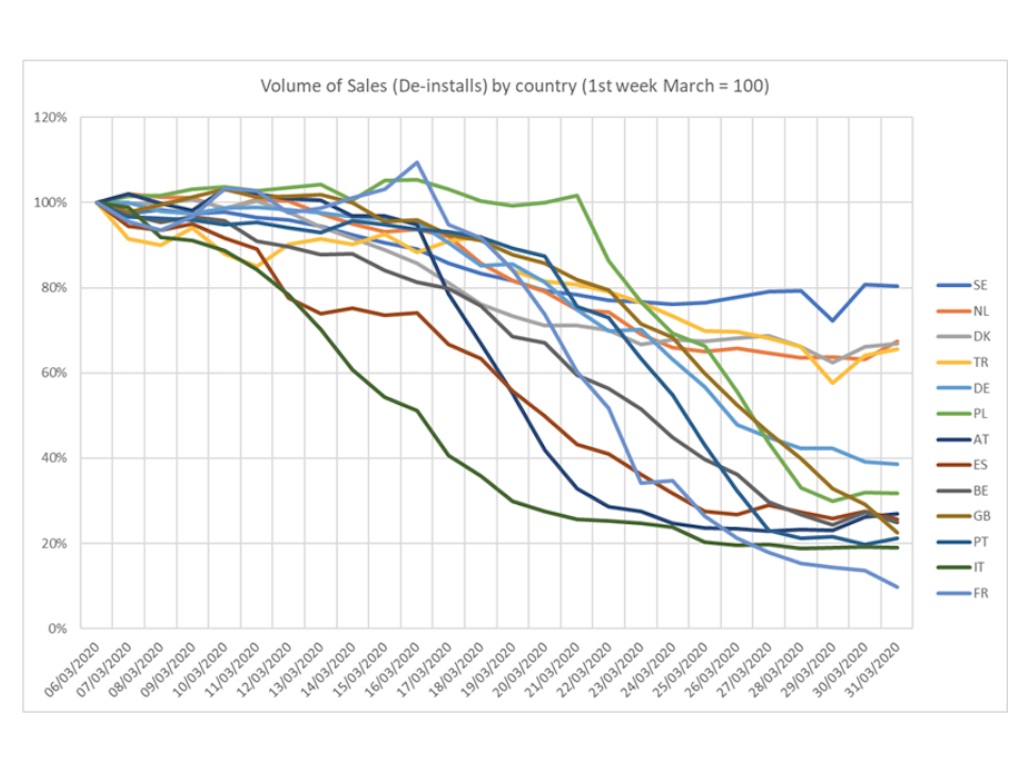

The featured graph on volume of sales shows the stark difference between the markets in full lockdown, and those with some residual used car trading. Indexing from week one in March, the resilience of Sweden retaining 80% of its used car volumes and Turkey, Netherlands and Denmark (retaining two thirds of its volumes) contrasts with the lockdown countries such as the UK where sales have dramatically fallen towards zero.

The firm added that MarketWatch data also highlights the lack of overall price movement in some countries and a correlation with the introduction in social distancing.

Looking at UK, Spain, Austria, Italy and France, where they went into lockdown with the hardest or fastest measures, dealers had minimal time to react before closure and experienced the fewest number of price changes. Conversely, Denmark, Belgium, Netherlands and Sweden progressed more slowly into social distancing and their fall in volumes were either slower or less pronounced than other countries. As a result, their dealers had time to react by dropping prices.

Analysis of individual countries such as the Netherlands showed small cars sustained values initially better than larger vehicles, both from a £ value and a percentage, typical of a market slide.

Turkey at 7.5% may appear to show remarkable growth. But in line with recent market growth rates, a 10% rise would have been expected. The move to used cars as ‘a safe asset’ fuelled by the lack of new cars and relatively cheap consumer finance has potentially created a market price bubble.

“Market Watch gives further support to the used car industry to help make sense of how to manage the impact of Covid-19. Our PDF and web portal provide used car decision makers with the best real time data to build both a short term and long-term strategy to efficiently manage used car supply and demand,” explained Andy Shields, Indicata’s global business unit director.

Market Watch is available as a regular PDF hosted on the Indicata UK country website (visit here to sign up), while access to a more comprehensive web-based market reporting tool is available to senior decision makers in the leasing, rental, OEM and dealer group sectors.