Tesla and Dacia attract brand loyalty in the German market

At first glance, Tesla and Dacia could not be more different, yet they have one thing in common: extreme customer loyalty.

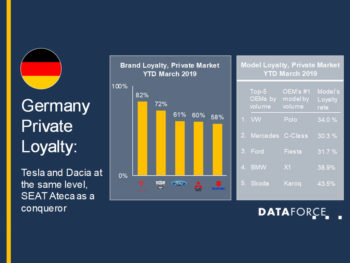

Customer brand loyalty for Dacia and Tesla is similarly high in the German market, Dataforce has revealed

Dataforce took a closer look at “Private Loyalty” results, which are updated monthly, finding that former Dacia or Tesla drivers remain loyal to the respective brand in more than 70% of all cases when changing cars.

The results contrast dramatically to those at the other end of the scale, which observe 8 in 10 former customers purposely turning to competitor brands.

In the German private market, the Volkswagen Golf achieved a loyalty rate of 23% in YTD February 2019, which means less than a quarter of former owners of this model opt for the same one again when buying a new car. 34% of other buyers switch to another model within the brand and not always into a larger vehicle, in some cases into smaller models. The remaining 43% turn their backs on the brand altogether. However, this was not always the case, says Dataforce’s Michael Gergen, as in 2015 the Golf achieved a loyalty rate of 35%.

Almost every new model launch is based on the manufacturer’s desire to win customers from its competitors. While some of the planned conquest rates turn out to be wishful thinking, the Private Loyalty statistics allows for clear data driven results. For example, the SEAT Ateca was launched in 2016: the data shows that 3 out of 4 current Ateca customers did not drive a SEAT before. Most of these new customers were won from outside the Volkswagen Group; primarily BMW, Mercedes-Benz and Opel from the 3 Series, C-Class and Astra respectively.