UK car industry met ZEV mandate last year, analysis reveals

All car manufacturers have successfully complied with the UK’s electric car sales mandate for 2024, new research finds.

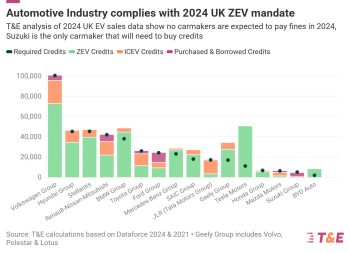

Clean transport advocacy T&E said its analysis of 2024 car sales figures from Dataforce found that no carmaker will pay penalties under the ZEV mandate, and just one, Suzuki, will need to purchase compliance credits.

That’s despite what the eco campaign group calls “alarmist claims from the auto industry about potential fines” and a consultation currently underway to explore potential adjustments to the ZEV mandate.

The mandate sets out the percentage of new zero-emission cars and vans that manufacturers will be required to sell each year up to 2030. This was set at 22% of all new cars sold and 10% for vans in 2024, rising to 28% for cars (16% for vans) in 2025, with a potential fine of £15,000 per non-EV sold. But vehicle makers can also comply with the mandate by reducing CO2 emissions from petrol and diesel sales, borrowing credits from future targets, and purchasing credits from other carmakers through “flexibilities”.

Boosted by the ZEV mandate, UK electric car (BEV) market share rose 19.6% in 2024, below the headline target of 22% but exceeding the 18% required for compliance when flexibilities in the law are counted.

In a statement early January, Stellantis said it was “one of the few OEMs in the UK to comply – through sales – with the ZEV mandate for both cars and vans in 2024”.

But the Department for Transport has already said it’s “confident that the whole industry will meet targets and that no car manufacturer will need to pay fines” thanks to the flexibilities in the ZEV mandate.

And T&E says Hyundai, Stellantis, BMW, Mercedes-Benz, SAIC and Geely (Volvo, Lotus, Polestar) all complied by both increasing BEV sales and reducing the average emissions of the combustion engines they sold.

The analysis also finds that VW, Renault-Nissan-Mitsubishi, Toyota, Ford, JLR, Honda, Mazda and Suzuki will need to supplement BEV sales and emissions reductions for 2024 by either borrowing credits from future years or purchasing them from over-compliant manufacturers. In practice, carmakers are likely to only go with the first option, T&E has said, as the latter would mean giving money to competitors. But as Suzuki will only launch its first BEV this year, it will need to purchase compliance credits to meet the early targets.

T&E found that no carmaker will pay penalties under the ZEV mandate, and just one, Suzuki, will need to purchase compliance credits

T&E said the flexibilities in the mandate are sufficient to ensure carmaker compliance, now and in the future, and the Government should resist calls to weaken the mandate further.

The current consultation on the ZEV mandate, which runs until 18 February, gives the industry the chance to have its say on how the current arrangements and flexibilities are working.

Launched after months of warnings from carmakers of “irreversible damage” from the EV rules, it looks at which hybrid cars can be sold alongside zero-emission models between 2030 and 2035, and any further support measures to help make the transition a success for industry and consumers.

But further to its own analysis, T&E has called on the Government to “stand firm against calls to water down the law and instead focus on delivering a robust industrial strategy”.

Anna Krajinska, director of T&E UK, said that as the ZEV mandate increases in ambition, carmakers are planning to introduce over a dozen EV models cheaper than £23,000 (around €27,200). If the mandate is weakened, these models risk being prioritised for other markets.

She continued: “Backtracking now on the ZEV mandate will endanger the £23bn (€30.8bn) in EV investments that has been committed to the UK. These investments are vital for driving economic growth and safeguarding high-quality UK automotive jobs. It would also undercut investment certainty that the charging industry needs to build out infrastructure.”