Comment: All roads lead to a very exciting future of mobility

Mobeen Tahir, director, macroeconomic research & tactical solutions, WisdomTree

In the classic 1980s film, ‘Back to the Future’, the protagonists, Dr Emmett Brown and Marty McFly, travel 30 years into the future. In the year 2015, their DeLorean time machine, which now runs on waste matter, is airborne in what appears to be heavy car traffic in the skies.

Although our skies don’t quite look like what was envisioned in the movie, ‘Back to the Future’ did get two things right. First, cars have found alternative fuels to run on. And second, the technology at our fingertips today bears no resemblance to what was there back in the 80s.

We know that as technology advances, the rate of change increases too. But we don’t need another dose of science fiction to imagine the future of automobility. All we must do is observe the megatrends already in motion.

At WisdomTree, we see the future of automobility as connected, autonomous, shared and electrified. This is exciting not just for car and technology enthusiasts, but investors as well.

Connectivity

Imagine you are driving on the motorway. You feel hungry. You verbally ask the car to search for good restaurants along the route, pick the one which optimises between the highest rating and your cuisine preferences, and add a stop on the navigation. This isn’t science fiction; some cars with high-tech infotainment systems can do precisely this. The Mercedes-Benz User Experience (MBUX) responds to “Hey Mercedes” and uses artificial intelligence to predict your personal habits. The more you drive it, the more likely it will find you a route you will enjoy most. It will also remind you when your next service is due. It knows, after all, how forgetful you can be…

In 2021, there were 236 million connected cars worldwide. A connected car is one that uses the internet to download, as well as upload, data. By 2035, this number could reach 863 million[1].

The connected car brings additional benefits as well. It can update its software automatically, such as your mobile phone. This means fewer trips to the workshop. It can also help you monitor critical safety information about the car remotely. This is especially useful for managers who need to maintain entire fleets of cars. Digital dashboards can enable them to monitor their fleet quickly and remotely, instead of checking each car manually.

Autonomous driving

Now, imagine being on the motorway again. Perhaps you don’t have enough time to sit at a restaurant, but you could pick something up and eat in your car while driving. Not very safe? Why not let the car drive itself while you enjoy your meal in the backseat and maybe even respond to some urgent emails.

Figure 1: The many flavours of autonomous mobility. Source: WisdomTree, Berylls, Leanval, 2022. VTOL is vertical take-off and landing

As illustrated in Figure 1, autonomous driving isn’t just for the hungry driver in a hurry, it will have a huge impact on all forms of mobility. Logistics is one example. The global drone package delivery market is expected to grow from $824 million in 2021 to $11,519 million in 2030, expanding at a compound annual growth rate of over 55%[2].

Autonomous mobility has many tangible benefits, including improving safety. Currently, approximately 1.3 million people die each year because of road traffic accidents[3]. Although there are regulatory and psychological barriers to overcome before full automation becomes the norm, assisted and partially automated driving is already making cars safer. As we progress along the continuum of automation, this dreadful statistic might hopefully be reduced.

Moreover, not always requiring humans to do the job will make logistics more efficient and cost effective. The UK, with its recent lorry driver shortage, could certainly have benefited from automated driving.

Shared mobility

Back to the motorway scenario again. This time, imagine you reach your desired restaurant in a town nearby only to find there is no parking. But what if you don’t need to park. You don’t own the car anyway. The car drops you off and goes to pick up another passenger. Once you’re ready to go, you call another car.

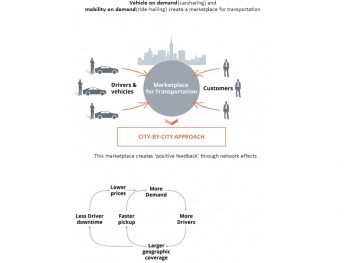

Figure 2: Cities need to find a way to meet people’s individual mobility needs without hurting the environment. Source: Hackermoon, Berylls, 2022

These days when we think of ride-hailing, we think of Uber as the alternative to calling a traditional taxi. But in many crowded cities, shared ownership can reduce the need for people to own cars. This could not only reduce the financial burden on individuals and city planners, but also help the environment.

Electrification

Let’s return to the motorway scenario one last time. This time you hear on the radio how terrible the weather is going to be the following week. As you ponder the state of the planet amid climate change, you feel assured that at least you have ditched your internal combustion engine car in favour of an electric one.

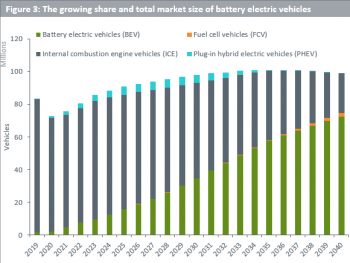

Road transportation accounts for almost 12% of all greenhouse gas emissions[4]. Electrification can, therefore, make a huge difference. A few years ago, electric vehicles were limited to the likes of Tesla and a handful of other car manufacturers. Today, most car makers have rapidly growing ranges of electric models. Electric vehicle sales doubled in 2021 compared to 2020 and reached 6.6 million worldwide. All of this in a year when the automobile industry was faced with semiconductor chip shortages. By 2040, electric vehicles will dominate sales worldwide (see Figure 3 below).

Source: BloombergNEF, as of 01 June 2022. Drivetrains: BEV (battery electric vehicles), PHEV (plug-in hybrid electric vehicles), FCV (fuel cell vehicles), ICE (internal combustion engine vehicles). ICE includes self-charging hybrids. Types: Shared (digital-hailing, taxis, car-sharing and autonomous vehicles operated in a shared fleet), private (privately owned vehicles). Forecasts are not an indicator of future performance and any investments are subject to risks and uncertainties

Electrification (that is, making cars that run on lithium-ion batteries) isn’t the only innovation car makers are pursuing. Manufacturers are actively exploring alternative fuels like hydrogen. Daimler already has hydrogen fuel cell trucks under testing. Car makers are also innovating with cutting edge technologies like wireless charging. BMW is an example in this space. After all, it will be easier for autonomous cars to park themselves over bays where they can charge wirelessly, rather than finding a way for cables to be connected somehow.

How can investors capture these megatrends?

The automotive ecosystem can be split into five key segments.

1. Original equipment manufacturers – companies developing, manufacturing and selling vehicles.

2. Suppliers – companies developing, manufacturing and selling software, hardware or engineering services for vehicle development.

3. Dealers and aftermarkets – companies buying and selling vehicles or providing platforms for doing so. Likewise, servicing, optimising and repairing vehicles after they have been put into operation.

4. Infrastructure – companies developing, operating, and maintaining the infrastructure required for industry transformation (for example, charging, hydrogen refuelling).

5. Mobility service providers – companies providing mobility services (B2B / B2C)[5].or providing the platform for a third party to provide mobility services. An exposure across the five segments can help investors capture the megatrend of future mobility.

Expect change. Expect innovation. Expect excitement. The mobility ecosystem is evolving rapidly to meet the changing needs of consumers and cities, and to tackle climate change. And, it is starting to get a lot of attention from investors.

Footnotes

1 As per September 2021 forecasts from Statista.

2 According to Research and Markets ‘Drone Package Delivery Markets’ July 2022 report.

3 According to the World Health Organisation June 2022.

4 Our World in Data 2020.

This material is prepared by WisdomTree and its affiliates and is not intended to be relied upon as a forecast, research or investment advice, and is not a recommendation, offer or solicitation to buy or sell any securities or to adopt any investment strategy. The opinions expressed are as of the date of production and may change as subsequent conditions vary. The information and opinions contained in this material are derived from proprietary and non-proprietary sources. As such, no warranty of accuracy or reliability is given and no responsibility arising in any other way for errors and omissions (including responsibility to any person by reason of negligence) is accepted by WisdomTree, nor any affiliate, nor any of their officers, employees or agents. Reliance upon information in this material is at the sole discretion of the reader. Past performance is not a reliable indicator of future performance.