On the move: Latest Intelligent Mobility developments revealed

Frost & Sullivan’s ‘Intelligent Mobility’ conference covered plenty of new ground and threw up some interesting insights into vehicle use in the future. By John Challen.

Recognising the evolving transport industry – and future role of the passenger car – Frost & Sullivan’s Intelligent Mobility 2019 conference in London outlined new use cases and business models for existing and future technologies. It also gave new entrants and those looking to break into the core automotive cluster a chance to plead their case to the industry audience.

Sarwant Singh, managing partner at Frost & Sullivan, kicked off proceedings with some analysis and predictions about the automotive market. He described the car world as a marketplace with different payment gateways thanks to better connectivity and infotainment features, a move that could impact on every element of the journey – entertainment, food, hotels, etc.

“The emergence of IoT platforms means that everything will become a platform, but how can you distinguish between them?” he asked. “Most car companies are leaning towards the software manufacturers, but Volkswagen has invested internally in software and developed its own. It will be the first IoT platform to come onto electric vehicles, the benefit being that it is customer-driven and there is a great deal of personalisation.”

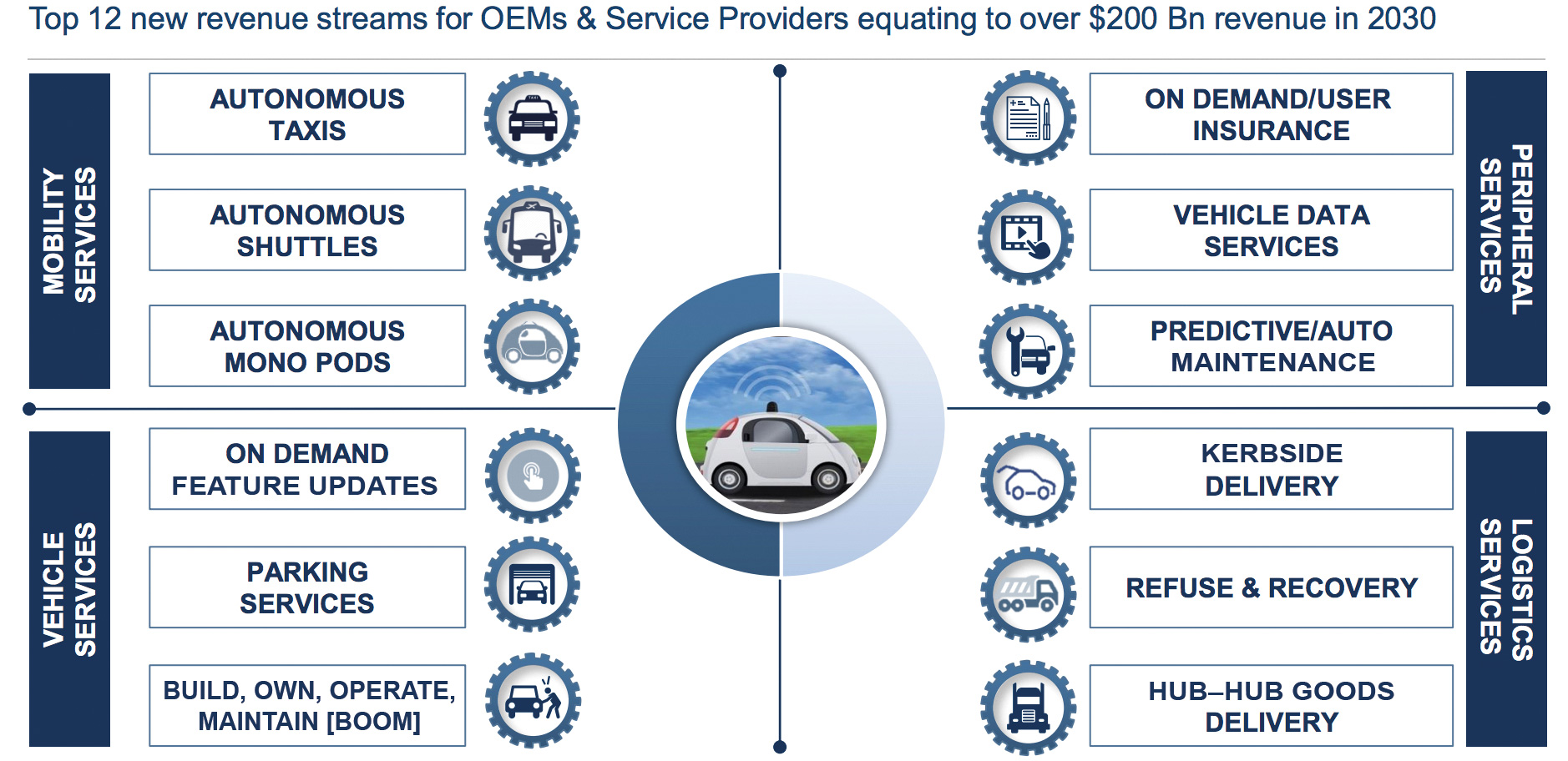

Singh isn’t expecting Level 5 autonomous vehicles until after 2030 and predicts demand for autonomous taxis in China and driverless shuttles in Europe and elsewhere. He does, however, expect a lot of value in future mobility. “We see a US$200bn industry and manufacturers moving to the BOOM (Build, Own, Operate, Maintain) model, considering 6/8-seat variants to stay relevant,” he said. “We also see huge growth in downstream models, especially ride-hailing, which we expect to be worth US$900bn by 2025. Companies such as Uber need to build subscription services and a customer loyalty programme to stay ahead and differentiate between other e-hailing services.”

Autonomous driving services in four areas will account for 65% of the market by 2030, says F&S.

Fuel of the future

Energy companies – like vehicle manufacturers – are learning to adapt to new market conditions in the face of emerging alternative power sources. Spencer Dale, group chief economist at BP, told the audience that he recognised the growth of EVs in the next 20 years, predicting that global EV numbers could reach 400 million by 2040. But he also warned that obsessing over the volume is missing the point. “The impact goes beyond just numbers because we are seeing the emergence of shuttles, which moves away from traditional vehicle use cases,” he said. “When thinking about EVs, at BP we don’t think about the number of cars, we think about the number of kilometres travelled. Each EV is being used more intensively than before, but it has a trivial impact on oil. The world uses 100m barrels of oil a day. The growth of EVs will only reduce that figure by up to five barrels a day.”

Dale added that prosperity would be a big trend that would affect mobility. “One third of the population will move from low- to middle-class in the next 20 years, so therefore will transfer from mass transit to personal mobility. The cost of using cars will subsequently reduce over time, leading to increased car use and a need to ration that use. It seems almost inevitable that there will be more active rationing of travel such as road pricing.”

Fellow BP man, Roy Williamson, the head of advanced mobility at the company, stated that it needed to reflect its overall role in the industry, given that some vehicle manufacturers are becoming energy providers. “Our approach is to say we need a new way to do business,” he said. “It’s not competitive work, it’s collaborative work. Conversations are taking place between different parties that wouldn’t have happened 3-5 years ago. We run 6,500 public charging points and our vision is to offer ultra-fast charging that is convenient, as well as home- and consumer-friendly options.”

As for the future of the traditional service station? In good health, according to Williamson. “We will continue to provide energy, regardless of what it is,” he confirmed. “Retail estate today is an advantage because many sites make more money from the products they sell in the store than the fuel. There are big opportunities to shift the business model, to last-mile delivery, for example.”

Mobility mindhive

Mobility is the new mantra and for Europcar it means a fundamental lead for society, according to Aurelia Cheval, chief strategy officer at Europcar’s mobility group. “Today, mobility is at a pivotal point, we have communities growing everywhere and if we don’t change anything by 2050, 40 billion people will be hitting the road every day. We are facing increased CO2 emissions and know it isn’t sustainable. Climate change is a big challenge and we must reduce our carbon footprint,” she urged.

Cheval said that the next generation shared much more, including their mobility experiences. “Ownership is a thing of the past and a shift to usership has taken place in many big cities. In Paris, 70% of people don’t own a car so we need to build our brand to support usership. We are partnering with people to support future approaches, for example MaaS.”

Explaining that one shared car is replacing up to 15 private cars, Cheval said the goal at Europcar was open mobility for all its customers where their live, work and travel. “We want to connect the digital and physical worlds.”

Rainer Feurer, SVP of mobility and energy services at BMW Group, then told the audience that the company was moving from a traditional OEM to a MaaS provider. “We are working in all areas [of future mobility]; we will have 23 EVs by 2023 – 10 of these will be battery-only. But we are also working on AVs,” he confirmed. “Besides technology changes, we are fully aware of a systems change and it is something BMW has worked on for many years.

“Now we have 1,000 people for one car, which is different from one customer for one car,” he added. “We won’t change overnight, which is why, 10 years ago, we started building up relationships and invested in parking and charging technology, including working with Daimler.”

Feurer doesn’t believe that car-sharing will solve mobility issues because while people will use it, they will still own a car. “We need to get 7/8-year-old cars out, but solutions to replace them are needed. We have a big opportunity to increase the quality of life in cities, but only by working with others through pilot studies. Potential solutions we have are increased e-zones, residential car-sharing and car-sharing at work.”

Daimler itself was represented at the event by Daniel Deparis, head of urban mobility at the German OEM’s mobility services function. He explained that Daimler’s urban mobility team was created to help make cities more liveable, something that was requested by the inhabitants. “They want help to make cities safer and transportation needs to be more efficient,” he explained. “Finally the goal is to give all people access to mobility and make that access greater for everyone.

“We are all working on connectivity, autonomous vehicles, revising standards, parking and EVs – we are not just a hardware or software company; more a mix of the two,” Deparis stated. “Daimler has invested in all areas and now has a wish to partner with others to grow that part of the business. We need to consider that sometimes the car is the best option.”

Digital and data dilemmas

The second session of the day explored the digital transformation of the automotive industry, the first speaker being Jonathan Allen, global practice manager – automotive at AWS Professional Services, an Amazon spinoff company. He assured the audience that Amazon is more than a book seller and that it is, in fact, the largest cloud supplier in the industry.

“When you look at how we take a view about connected vehicles, we connected a network to bring data in and connect with the fleet. We’ve connected with BMW and Avis and seen improvements in how they do business,” he said, then expanding on projects with other vehicle OEMs. “Online digital sales have grown 200% since 2016 – with Audi we created a digital showroom that allows you to connect with the vehicle. With Volkswagen, we’re going to connect its factories in the cloud and have a central environment in Berlin. We are disrupting the auto market and bringing the larger eco-system to that market, which is really exciting.”

Oxbotica has been one of the major success stories in the autonomous sphere in recent years, so it was no surprise to hear the company’s CEO, Ozgur Tohumcu explain how it was going to transform multiple industries around the world. “In 2026 we think that autonomy software market will be worth US$50bn. Autonomy has the ability to change the quality of life for a number of reasons. There is the safety aspect, improved efficiency efficiency and a reduction of carbon emissions,” he said. “If you are serious about autonomy you build your own software.”

He also pointed out the growth in data and the need for that data to be managed. Comparing the 0.1-0.5TB of data a day generated by today’s connected car with the 10-30TB a day generated by an autonomous car enabled greater value to be gained and the ability to transform the HMI.

Put the people first

Edwin Colella, VP, mobility sales and marketing at Omoove, warned not to get too involved in the technology because it is the human who must be taken into account at the beginning of the connected journey. “Over the next few years, we need to look to phase out connected systems from the aftermarket as more and more factory-fitted technologies emerge,” he said. “With the Renault Zoe, there is a factory-fitted device that allows the vehicle to be used for car-sharing. The value chain of these services features many different players and we need to deliver services for analytics and car-sharing at the same time.”

Colella added that the previous 1:1 relationship of car:user was useful for insurance purposes, but now presented a challenge for OEMs and fleet and service providers. “The value out there is significant – we are all here because we recognise a business opportunity in the future,” he said. “Managing these services for OEMs will not be easy. In this context, if we know the services we need, we have to imagine a way for those services to fit within all areas of the automotive industry, such as the driver, vehicle and the value-added service partner. Every company and service needs to look at this situation and see how they can get the most out of the industry. Many people don’t know or appreciate what is happening with connected vehicles, autonomous or mobility so we need to help and educate them.”