European car market drops in June, as SUV sales decline

Following two consecutive months of growth, the European car market dropped in June by 7.9%, with 1.49 million vehicles registered, reports Jato Dynamics, with fingers pointing at the continued demise in diesel sales and for the first time a decline in SUV sales.

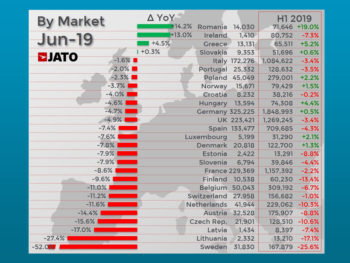

It was the biggest monthly drop so far in 2019, as only four out of 27 markets posted growth, but counted for a marginal 2.6% of total registrations.

Felipe Munoz, Jato’s global analyst, said: “June’s results confirm that conditions in Europe are getting worse. We continue to see a repeat of the same pattern: lower consumer confidence is mostly affecting diesel car registrations, which used to dominate the European landscape.”

“The most worrying result from June was not the continuous diesel decline, but the slowdown in demand for SUVs,” continued Munoz.

SUV registrations totalled 556,400 units during the month, up by only 0.7% compared to the 552,500 units of June 2018. “Although it was still the third highest month ever for sales in the segment (behind March 2018 and March 2019), there are two factors that explain the limited growth. The first is poor wider-market conditions are finally impacting SUVs, which are usually more expensive than regular car types. The second, which Jato Dynamics says is more concerning, is that SUV demand may be peaking after many years of growth. If the second explanation is true, then Europe could be losing its main driver of growth,” Munoz concluded.

Demand for premium SUVs fell by 5%, as a result of double-digit drops at Mercedes, Volvo and Land Rover. Seat (+37%), Dacia (+21%) and Volkswagen (+19%) countered the trend with growth, while the three most popular SUV models posted the biggest drops: Nissan Qashqai (-15%), Volkswagen Tiguan (-18%) and Peugeot 3008 (-18%).

In the Scandinavian market, electric vehicles are proving increasingly popular, to the detriment of diesel. In June, diesel car registrations in the four Scandinavian markets fell 52% to just 20,092 units, marking the first time that these cars were outsold by electrified vehicles (20,182 units).

The noticeable YoY drop can be partially explained by the record month of registrations seen in Sweden in June 2018, which came ahead of a new tax hike which hit the market in July of that year.

The European diesel/electrified market mix, however, is more contrasted.

In June 2019, diesel car registrations fell by 21% and made up 31% of the total market, while demand for electrified vehicles increased by 20%. However, electrified vehicles account for just 7.5% of all registrations.

Munoz explained: “The drop seen in diesel car registrations continues to be higher than the growth posted by electrified cars. In order to see a real change in their market position, electrified vehicles need to attract more consumers, or else they won’t be able to capitalise on the demise of diesel.”

Amongst all the automakers, Tesla posted the highest market share gain, as registrations increased from 4,034 units in June 2018 to 14,106 units last month. In June 2019, the Model 3 was Europe’s best-selling premium midsize sedan.

Toyota was the other big market share winner of the month. The new Corolla performed far better than the Auris, and the new Rav4 continued to climb the SUV rankings, hitting the top 10 mainstream compact SUVs. Along with Lexus, these brands controlled 72% of the hybrid car market in June.