Higher taxes on road fuels could plug Brexit budget gap

Increasing taxes on road fuels could be one of the ways to help mitigate a future €12bn-a-year gap as a result of the UK’s departure from the EU.

The proposal came last week from former Italian prime minister Enrico Letta, ex-WTO head Pascal Lamy, former finance minister of Germany Hans Eichel and 14 other economists who advocated the move to bring about new revenues from taxing transport, which is Europe’s biggest emitter of greenhouse gases.

In a letter to President Juncker, Commissioner Oettinger and European Finance Ministers, the leading economists said: “As the 2020 decade is approaching, European challenges require a common response to defend European security and freedom in a more dangerous world, protect Europeans from social injustice and climate change, and empower them through consistent support to research, innovation, training, mobility and civil society. More than ever, Europeans need a strong EU budget to tackle those challenges.”

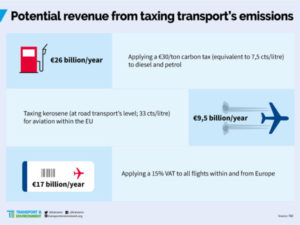

The move was welcomed by eco campaign group Transport & Environment. The firm’s analysis finds that even a portion of the income from new measures such as a carbon tax on motor fuels, aviation kerosene duty, and ending the VAT exemption for flights within and from Europe would address the post-Brexit deficit. But the bulk of the additional revenue would go to member states – enabling them to, for example, reduce labour taxes.

Samuel Kenny, freight policy officer at T&E, said: “The EU has long considered energy taxes as a way to cut Europe’s emissions. Now, with a budget gap looming and some of Europe’s top economists backing the idea, the logic behind a green tax shift to transport, the biggest source of climate emissions in Europe, is more compelling than ever.”