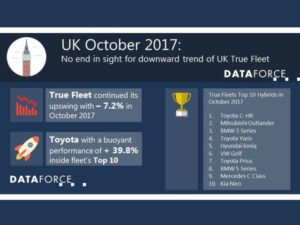

UK True Fleet slumps while AFVs climb

In October, the British True Fleet market remained in a slump for the seventh consecutive month, while in contrast alternative fuel vehicles (AFVs) increasingly buck the trend, according to latest DataForce figures.

UK October DataForce figures show strong AFV sales, while the market continues to slump overall

The fleet segment was down by 7.2%, which after ten months led to a cumulative slip of 4.5%. The Private Market softened by 10.1% while even the Special Channels could not compensate for the performance of the private and the fleet segments and declined by 27%. Overall, the Total Market decreased by 12.2% in October, finishing with 158,000 passenger car registrations.

The top ten brands of October ranked, in order, were Ford, Volkswagen, Opel, Mercedes-Benz, Audi, Nissan, BMW, Hyundai, Kia and Toyota. Big movers amongst this group were Hyundai, with a sales increase of 35.6%, with Tucson, Ioniq and i20 performing well. And Toyota saw the highest level of growth with 39.8% thanks predominantly to the Aygo, Yaris and C-HR.

In contrast to declining overall registrations, alternative fuels continued their rise with a current year-to-date fleet market share of 5.8%, indicating an increase of 1.3% compared to 2016. In October the alternative segment increased by 40.2% year-on-year, pushing cumulative growth towards 25.4%. Stars amongst this sector were the Toyota C-HR Hybrid, Hyundai Ioniq, Volkswagen Golf and Passat GTE, Kia Niro and BMW 530e iPerformance.